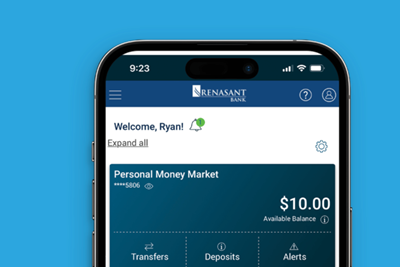

Pay your bills anytime, anywhere!

With Bill Pay, you can make online payments without writing checks, addressing envelopes, buying stamps or making trips to the post office.

- Schedule automatic payments or reminders up to one year in advance.

- Save and store payee details for future payments.

- Reduce the risk of fraud, lost or stolen checks by sending electronic payments.*

- Create and review reports of all your past payments.

Best of all, Bill Pay is absolutely free to use!

Click here to view our online banking guide.

Additional Details

- You must be enrolled in Online Banking to use Bill Pay.

- You are able to choose the date on which the payment is to be sent by Bill Pay to the payee.

- The Bill Payment service within Online Banking will indicate whether a payee is paid electronically or by check.*

- Funds for payments made by check will be debited from your account when the payee receives and deposits the check.

- Funds for electronic payments will be debited from your account on the scheduled payment date.

Stop Payments

- If paid electronically: You may cancel a pending electronic payment on the Bill Pay page in Online Banking.

- If payment converted to check: To place a Stop Pay on an uncleared Bill Pay payment that will be paid by check, contact the Service & Solutions Center at 877.367.5371 or visit your nearest Renasant location.

- A $36 Stop Payment fee will apply to each transaction to be paid by check.

*Bill payments to payees who are not set up to receive electronic payments will be made with a check drawn on your account. Each check will have your account number and Renasant Bank’s routing number. The default starting check number will be 9000. Your cleared Bill Pay check images can be viewed after signing in to Online Banking.

Renasant Bank Privacy & Security

Renasant Online Banking is available to all Renasant Bank consumer online banking customers. The Bill Pay feature of our suite of online products is available when there is sufficient available balance for the transfer or bill payment.

Because it is of utmost importance to protect your personal information, we go to great lengths to make sure that your transactions are confidential and secure when you are banking online. Renasant Online Banking and its related bank products use encryption technology and other security measures to protect the confidentiality of transactions. Although we work hard to ensure the security of our systems, it is equally important that you take appropriate steps to protect the matters within your control, such as protection of user names and passwords, antivirus and spyware software for your computer, and avoidance of phishing email messages. Click Online Security for more security information and tips.

Subject to additional terms and conditions and/or fees if applicable, including internet provider and data charges.

After a weekend of very subpar refereeing, the conference holds their weekly SEC teams in the top ten meeting and they get the zebras to show up as special guests.

Renasant strives for simplicity and efficiency — especially when it comes to the busy lives of our customers. That’s why we’ve installed ATMs with Live Banker throughout various markets and are adding more.

For more than 40 years, baseball broadcasters Jim Ellis, John Cox, and David Kellum have had the privilege of calling college baseball on the radio. These legendary announcers share memories of their time and how they made it to the broadcaster's booth.

Check out some simple ways on how to teach your children to make financial decisions. Prevent them from making the same mistakes you did as well as keeping their eyes and wallets the same size.

The Doggie Camel Pack is a revolutionized way to help dogs lighten the load of a hike by carrying their own gear. It is a self-serving hydration pack set to keep a man's best friend happy and healthy.

Check out a few of our tips on buying a home. From mortgage options to house hunting seasons and homeownership responsibility, Renasant has you covered.

Only have one type of account? Checking handles your day-to-day transactions while savings holds your money for a longer period. Read here to learn more about checking and savings accounts.